Join the Cashfree Partner Program and offer your clients a powerful suite of online payments products. You can integrate Cashfree with your product or refer to earn rewards.

When you join Cashfree as a certified partner you get best in industry commissions on every transaction your referred clients make.

TABLE OF CONTENTS

- Become a Cashfree Partner

- Complete Partner KYC to activate account

- Refer or add merchants to Cashfree partner account

- Refer merchants using Cashfree Partner badge

- Refer merchants using Cashfree Partner referral links

- Add merchants directly on your partner dashboard

- Onboarding process of referred merchants

- Partner commissions

- Calculating your commission

- Commission settlement process

- Track your earnings

- KYC-details

- Business details

- Document checklist

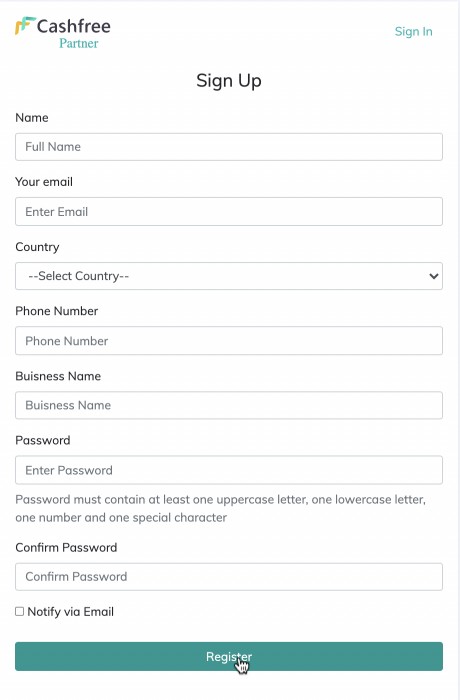

Become a Cashfree Partner

Go to Cashfree Partner Sign Up page , and fill all the required fields and click on ‘Register’

Once you sign up as a partner with Cashfree, you will get a ‘Partner welcome email’.

Complete Partner KYC to activate account

Once you sign up as a Cashfree Partner, you will receive a ‘Partner welcome email’

- You can reply to the same email with the required business details and documents to complete KYC process

- Cashfree team will verify all the details shared by you and complete your account’s KYC to enable settlements within 48 hours of submitting all documents

Please note: Commission settlement will be made only for accounts for which KYC has been completed.

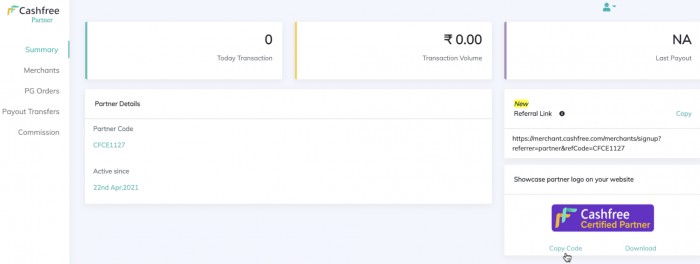

Refer merchants using Cashfree Partner badge

- On the summary tab, click on ‘Copy Code’

- Add this code on your website/App

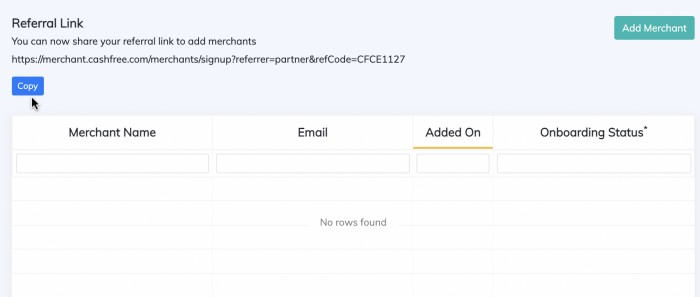

Refer merchants using Cashfree Partner referral links

- Copy your unique partner referral link and share it with your clients

Add merchants directly on your partner dashboard

- Click on ‘Add merchants’ and fill all the required details

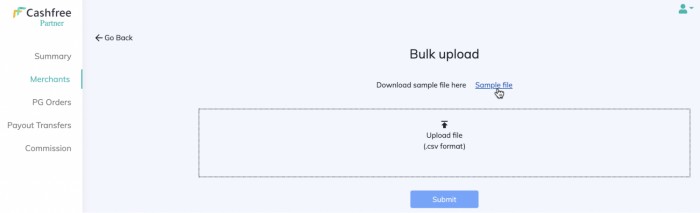

- Alternatively, you can also add details of multiple merchants instantly through the ‘Bulk upload’ option. For this

- Download the sample CSV file by clicking on the 'Sample file' link

- Upload the details of your merchants in the exact same format

- After uploading the CSV, you would be able to see ‘number of entries’, ‘successfully added’, ‘failed’ entries and also will be able to download the result CSV to check the exact reason for failur

Onboarding process of referred merchants

Once you’ve added the merchants, Cashfree will notify the merchant to accept the invite & verify their email ID. The merchant will be required to submit the business details and upload the required documents.

To make the merchant onboarding quicker, you can also submit business details of your merchants and upload the required documents on your merchants' behalf in these simple steps:

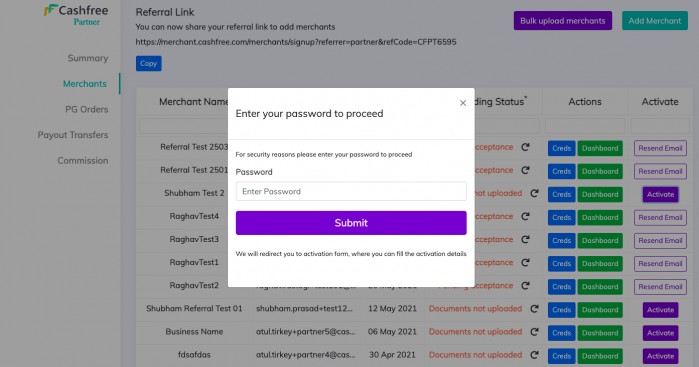

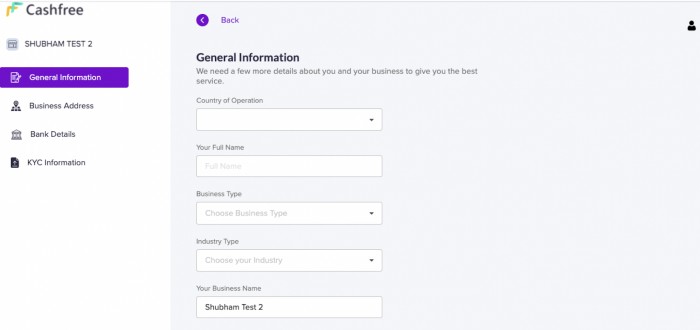

1. Click on the ‘Activate’ option shown for your merchant entries in the partner dashboard

2. You would be directed to the merchant account activation page where you can fill all required business details of your referred merchant and upload their business documents

3. In case the merchants don’t verify their mail IDs, you can also resend the verification email to them by clicking on ‘Resend verification email'

Please note: This ‘Activate’ option will only be shown for those merchants who have verified their email address

Partner commissions

By becoming a Cashfree partner, you can offer your clients a complete suite of online payments related products to manage their entire payment lifecycle and earn lucrative commissions. There are two types of commission structures:

1. Flat rate

2. Percentage of the transaction value

Calculating your commission

Commission as a flat rate

Let’s assume that you’re an e-commerce automation platform and you help e-commerce businesses in converting COD orders to pre-paid . Let’s say one of your clients, ABC Ltd..,collects ₹10,000 using Cashfree and you have offered Cashfree’s payment gateway to your ABC Ltd. at a markup of ₹100 over Cashfree’s base rate of 3% (Minimum amount that would go to Cashfree).

| Transaction amount (A) | Cashfree's charge (Base rate) (B) | Your markup (C) | GST (D) | Total amount paid by your client |

| ₹10,000 | 3% (10,000*3%) =

₹300 | ₹100 | (300+100)*18% = ₹72 | B+C+D = ₹472 |

Commission as a percentage of the transaction amount

Let’s assume you have offered Cashfree’s payment gateway to ABC Ltd. at a markup of 1% instead of INR 100 over Cashfree’s base rate of 3% (Minimum amount that would go to Cashfree

| Transaction amount (A) | Cashfree's charge (Base rate) (B) | Your markup (C) | GST (D) | Total amount paid by your client |

| ₹10,000 | 3% (10,000*3%) =

₹300 | 1% (10,000*1%) =

₹100 | (300+100)*18% = ₹72 | B+C+D = ₹472 |

Commission settlement process

In case of Payment Gateway colections, when any customer makes a transaction on your referred merchant’s website/app and the amount is settled to Cashfree, the commission on that transaction is reflected on your partner dashboard.

In case of Payout disbursals, when your referred merchant makes a payout for vendor payments, processing refunds or disbursing loans etc. using Cashfree, the commission on that transaction is reflected on your partner dashboard.

Here's how you can initiate your commission settlement process:

- On the first day of every month, calculate and create an invoice for the commission amount receivable for the previous month. i.e on 1st June,2021, create an invoice for the commission receivable for May. You can obtain details of the commission from your partner dashboard

- The invoice you create should have your company’s & Cashfree’s GSTN, and amount details

- Send this invoice to finance@cashfree.com at the beginning of every month

Please note: You will be able to claim your commission only if your partner KYC is complete and the commission structure is configured on your Cashfree partner account.

In case the commission structure is not configured on your partner account, please reach out to partners@cashfree.com.

Track your earnings

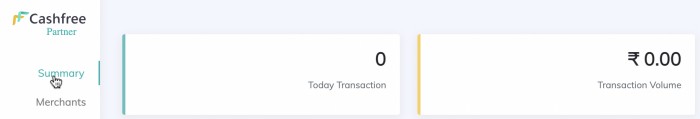

1. Navigate to Partner Dashboard > Summary to check total daily transactions and daily transaction volume

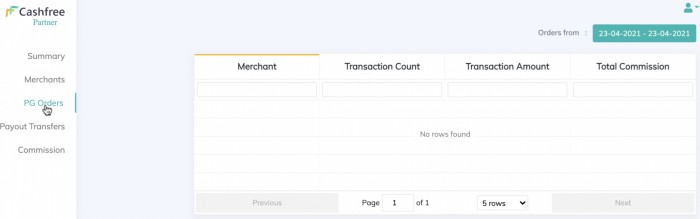

2. To track payment gateway transactions by your merchants, navigate to ‘PG Orders’ on the left panel. You would be able to view the number of transactions, total transaction amount and commission earned by you on those transactions for every merchant

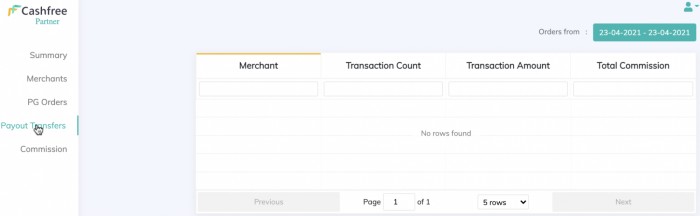

3. Similarly you can navigate to ‘Payouts transfer’ on the left panel to keep track of all transfers made by your merchants using Cashfree Payouts, and check the total commission earned on the transactions

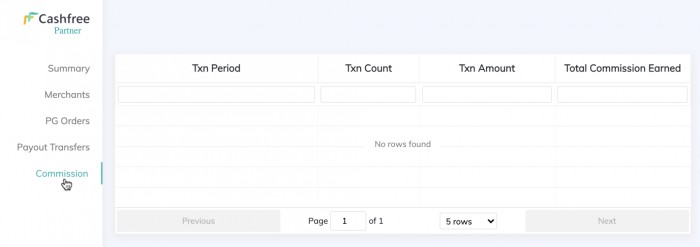

4. You can also keep a track of total commission earned on transactions for a particular period by navigating to ‘Commissions’

KYC-details

Business details

The following business details are required to complete the KYC of Cashfree partner account:

- Website URL

- Official email ID

- Official Contact name & number

- Bank account number

- Bank account holder name & IFSC

Document checklist

1. For individuals

- Pan Card

- Address proof (DL/voter ID/Passport)

- Cancelled Cheque/Bank statement

2. For Proprietorship

- Business reg. proof (GST certificate/Shop act licence/labour licence/ MSME certificate/Trade license)

- Proprietor's PAN Card

- Proprietor's address proof (DL/voter ID/Passport)

- Cancelled cheque/Bank statement

3. For Partnership/LLP

- Business reg. proof (Partnership Deed/ LLP COI)

- Business PAN card

- Authorized signatory PAN card

- Authorized signatory - address proof (DL/voter ID/Passport)

- Cancelled cheque/Bank statement

4. For Private Ltd./Public Ltd. entities

- Certificate of Incorporation

- Business PAN Card

- Authorized signatory/director's PAN card

- Authorized signatory - address proof (DL/voter ID

/Passport) - Cancelled cheque/Bank statement

- MOA & AOA

We hope this helps you create a Cashfree Partner account, manage referred merchants and earned commissions. In case of any queries please feel free to contact us at partner@cashfree.com or care@cashfree.com. We would be happy to assist.